Detailed and simple analysis of the Supreme Court case and the related High Court judgment regarding GST notifications and limitation extensions under Section 168A of the CGST Act.

Section 168A allows time extensions, but they must be justified properly.

✅ Force majeure must exist at the time of issuing a notification.

✅ GST Council recommendations are mandatory for such extensions.

✅ Courts will review extensions carefully to prevent misuse of power.

✅ The Supreme Court will ultimately decide whether the notifications are valid.

This case highlights the delicate balance between the government’s power to extend deadlines and the need for proper legal compliance. The Supreme Court’s decision will have a major impact on future GST proceedings.

- The main dispute was about the validity of notifications issued under Section 168A of the GST Act that extended the time limit for tax authorities to issue notices and pass orders.

- The petitioner challenged three notifications:

- Notification No. 13/2022 (dated 5-7-2022)

- Notification No. 9/2023 (dated 31-3-2023)

- Notification No. 56/2023 (dated 28-12-2023)

- The government issued these notifications to extend the time limit for tax adjudication, particularly for the financial year 2019-20.

- The petitioners argued that these extensions were unlawful because they were issued after the COVID-19 pandemic had ended and were not backed by force majeure conditions.

Key Legal Issue

- The main question before the court was: “Can the government extend the time limit for issuing tax notices under Section 73 of the GST Act by using Section 168A, even after the COVID-19 pandemic ended?”

- The petitioner argued that force majeure (unavoidable circumstances) must exist to use Section 168A.

- The government claimed that administrative difficulties also justified the extensions.

High Court’s Observations

The High Court examined five key issues before making its decision.

1. Was the extension under Section 168A legally valid?

✅ Government’s Argument:

- The government can extend time limits if there are exceptional circumstances.

- The COVID-19 pandemic created difficulties that affected tax proceedings even after it ended.

❌ Petitioner’s Argument:

- Section 168A can only be used when there is a force majeure event (like COVID-19).

- By 2023, COVID-19 was no longer a valid reason for extensions.

- The extension was arbitrary and unfair.

Court’s Finding:

- The validity of the extension depends on whether force majeure existed at the time of issuance.

- COVID-19 had ended, but administrative difficulties were considered a reason.

2. Did the force majeure condition still apply in 2023?

✅ Government’s Argument:

- Even though the pandemic ended, the GST department faced administrative delays due to pending cases.

- The Allahabad High Court previously ruled that administrative challenges can be considered force majeure.

❌ Petitioner’s Argument:

- The pandemic emergency was over by 2023, so the basis for extension was invalid.

- The government cannot use administrative inefficiency as an excuse.

Court’s Finding:

- Force majeure must exist when the notification is issued.

- The pandemic was over, but the court did not completely reject the government’s justification.

- The court considered other factors like backlog and administrative hurdles.

3. Did the notifications follow GST Council recommendations?

✅ Government’s Argument:

- The government has the power under Section 168A to extend deadlines even without GST Council recommendations.

❌ Petitioner’s Argument:

- Section 168A explicitly states that GST Council recommendations are mandatory.

- The government cannot issue these notifications without proper approval.

Court’s Finding:

- The requirement for GST Council recommendations was not followed for Notification No. 56/2023.

- This weakened the government’s position and made the notification legally questionable.

4. Did the Supreme Court’s COVID-related orders apply?

✅ Government’s Argument:

- The Supreme Court had extended limitation periods for various legal proceedings due to COVID-19.

- These extensions applied to GST proceedings as well.

❌ Petitioner’s Argument:

- The Supreme Court’s orders applied to taxpayers, not tax authorities.

- The tax department should have taken action on time instead of relying on extensions.

Court’s Finding:

- The Supreme Court’s orders did apply to tax matters, but they covered only up to February 28, 2022.

- The government’s further extensions beyond that required stronger justification.

5. Can the court review such notifications?

✅ Government’s Argument:

- Extending tax deadlines is a legislative action, and courts should not interfere unless there is a clear legal violation.

❌ Petitioner’s Argument:

- The court has the power to review government actions if they violate statutory requirements.

- Section 168A was misused, so the notifications should be struck down.

Court’s Finding:

- While the government has discretion, it must follow the law.

- Section 168A cannot be used arbitrarily.

- The court found procedural flaws in Notification No. 56/2023.

High Court’s Final Judgment

- The court upheld the government’s power under Section 168A but expressed concerns over its misuse.

- The period from March 15, 2020, to February 28, 2022, was excluded from limitation due to the Supreme Court’s orders.

- The challenge against the notifications was dismissed, meaning the government could still extend deadlines, but only with proper justification.

- The requirement for GST Council recommendations must be followed, and Notification No. 56/2023 was legally questionable because it lacked this approval.

- Petitioners were allowed to file statutory appeals within 45 days, and these appeals would not be rejected on the ground of limitation.

Current Status: Supreme Court Appeal (SLP)

- The case has now gone to the Supreme Court as a Special Leave Petition (SLP).

- The Supreme Court has issued a notice on the matter and will hear it on March 7, 2025.

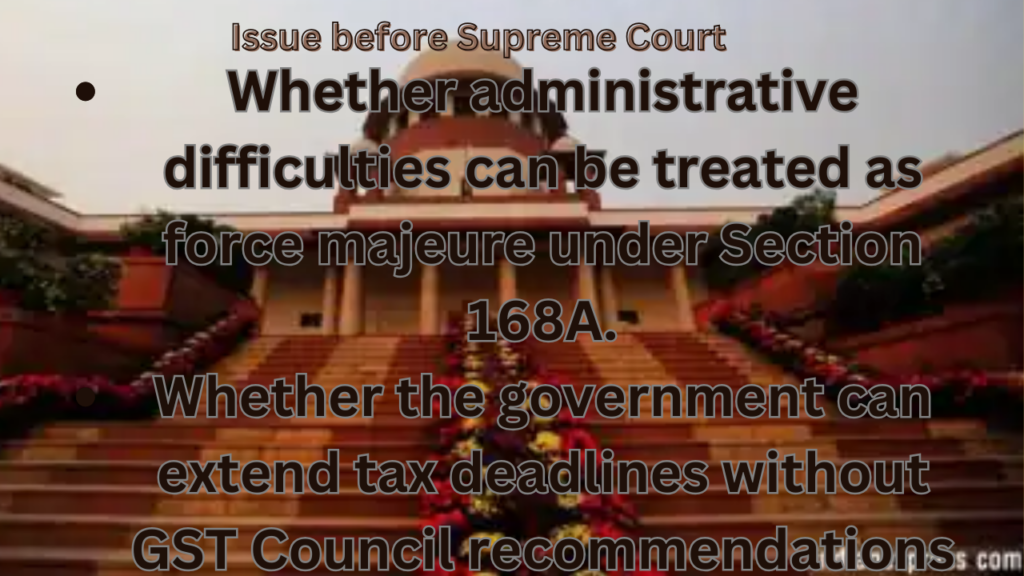

- A key issue before the Supreme Court will be:

- Whether administrative difficulties can be treated as force majeure under Section 168A.

- Whether the government can extend tax deadlines without GST Council recommendations.