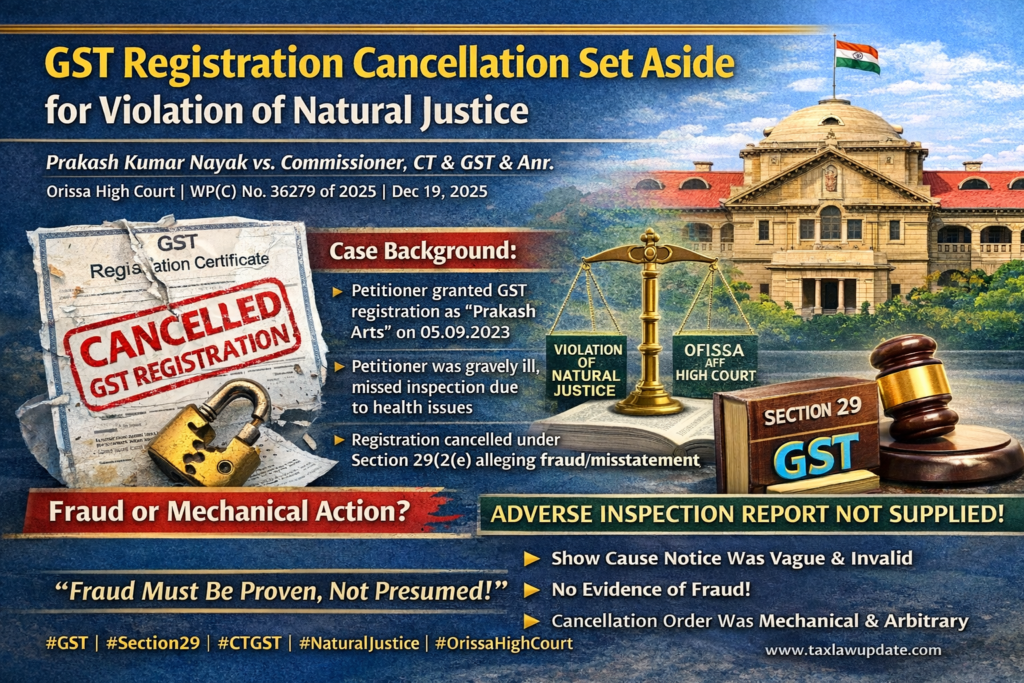

Prakash Kumar Nayak vs. Commissioner, CT & GST & Anr.

Orissa High Court | WP(C) No. 36279 of 2025 | Decided on 19 December 2025

🔹 Introduction

In a significant judgment reinforcing the principles of natural justice and procedural fairness, the Orissa High Court in Prakash Kumar Nayak vs. Commissioner, CT & GST held that GST registration cannot be cancelled mechanically on vague allegations of fraud or misstatement, especially when the assessee was not supplied with the adverse material relied upon by the department.

The Court strongly disapproved of summary cancellation of registration under Section 29(2)(e) of the GST Act without furnishing reasons or evidence, and restored the registration after quashing both the show cause notice and cancellation order.

🔹 Facts of the Case

✔ Parties Involved

- Petitioner: Prakash Kumar Nayak

- Respondents: Commissioner, CT & GST and another

- Court: Orissa High Court

- Business Name: Prakash Arts

- GST Registration Granted: 05.09.2023

✔ Background

- The petitioner was granted GST registration after submission of:

- Aadhaar Card

- PAN

- Rent Agreement

- In November 2023, the petitioner suffered serious health issues and remained under medical supervision.

- During this period, a post-registration verification visit was conducted by GST officials.

- The petitioner could not be present due to illness.

🔹 Cancellation of Registration

🚫 Grounds Invoked by Department

The GST registration was cancelled under:

Section 29(2)(e) of CGST/OGST Act, 2017

“Registration obtained by means of fraud, wilful misstatement or suppression of facts.”

🚫 Reasons Cited:

- Adverse Post GST Registration Visit Report

- Non-response to notice dated 05.01.2024

🔹 Petitioner’s Contentions

✔ Registration was granted after due verification

✔ Illness prevented presence during inspection

✔ No fraud or misrepresentation committed

✔ No adverse report was supplied along with SCN

✔ Show cause notice was vague and mechanical

✔ Cancellation order lacked reasoning

✔ Opportunity of hearing was illusory

🔹 Stand of the Department

The Department argued that:

- The petitioner did not respond to the show cause notice

- Registration was rightly cancelled under Section 29(2)(e)

- Adverse inspection report justified cancellation

🔹 Key Findings of the High Court

✅ 1. Show Cause Notice Was Vague and Invalid

The Court observed:

- The SCN merely referred to an “adverse post-registration visit report”

- No copy of the report was provided

- No specific allegation of fraud or misstatement was mentioned

- Hence, the notice was vague, incomplete, and non-speaking

📌 Held:

A notice without disclosure of material allegations is non est in law.

✅ 2. Violation of Principles of Natural Justice

The Court held:

- The petitioner was not given a fair opportunity to defend

- Adverse material was never supplied

- Mechanical issuance of notice violates natural justice

📌 Important Observation:

“A person cannot be condemned without being informed of the exact allegations.”

✅ 3. Cancellation Order Was Arbitrary & Mechanical

The Court found that:

- The order merely reproduced Section 29(2)(e)

- No discussion on:

- What fraud was committed

- What facts were suppressed

- What misstatement was made

- No independent application of mind

📌 Key Finding:

The order was laconic, bald, and unsupported by evidence.

✅ 4. Illness of the Petitioner Was Genuine

The Court accepted:

- Medical records were produced

- The illness was not disputed by the department

- Absence during inspection was justified

✅ 5. Fraud Cannot Be Presumed

The Court clearly held:

“Unless there is cogent evidence establishing fraud, wilful misstatement or suppression of facts, registration cannot be cancelled under Section 29(2)(e).”

🔹 Final Decision of the Court

✅ Show Cause Notice dated 05.01.2024 — QUASHED

✅ Cancellation Order dated 19.01.2024 — SET ASIDE

✅ GST Registration Restored

✅ Petitioner allowed to file pending returns

✅ Tax and interest to be paid within 2 weeks

✅ Liberty granted to department if non-compliance continues

🔹 Relevant Legal Provisions

🔹 Section 29(2)(e), CGST Act

Registration can be cancelled only if:

- Obtained by fraud

- Wilful misstatement

- Suppression of facts

➡️ Must be supported by evidence, not assumption.

🔹 Key Legal Principles Evolved

| Principle | Explanation |

|---|---|

| Natural justice mandatory | SCN must contain clear allegations |

| Fraud must be proved | Cannot be presumed |

| Mechanical orders invalid | Authority must apply mind |

| Medical reasons valid | Absence must be reasonably considered |

| Cancellation affects civil rights | Higher degree of scrutiny required |

🔹 Practical Takeaways for Taxpayers

✅ GST registration cannot be cancelled casually

✅ SCN must disclose exact allegations

✅ Authorities must supply adverse material

✅ Illness or genuine hardship must be considered

✅ Courts will protect taxpayers from arbitrary action

🔹 Conclusion

This judgment reinforces the well-settled legal position that GST registration is a valuable right, and its cancellation has serious civil and business consequences. Authorities must act fairly, transparently, and in compliance with natural justice.

The Orissa High Court has once again reaffirmed that “fraud cannot be assumed — it must be proven.”

📌 Case Citation:

Prakash Kumar Nayak vs. Commissioner, CT & GST & Anr.

W.P.(C) No. 36279 of 2025

Orissa High Court | Decided on 19.12.2025