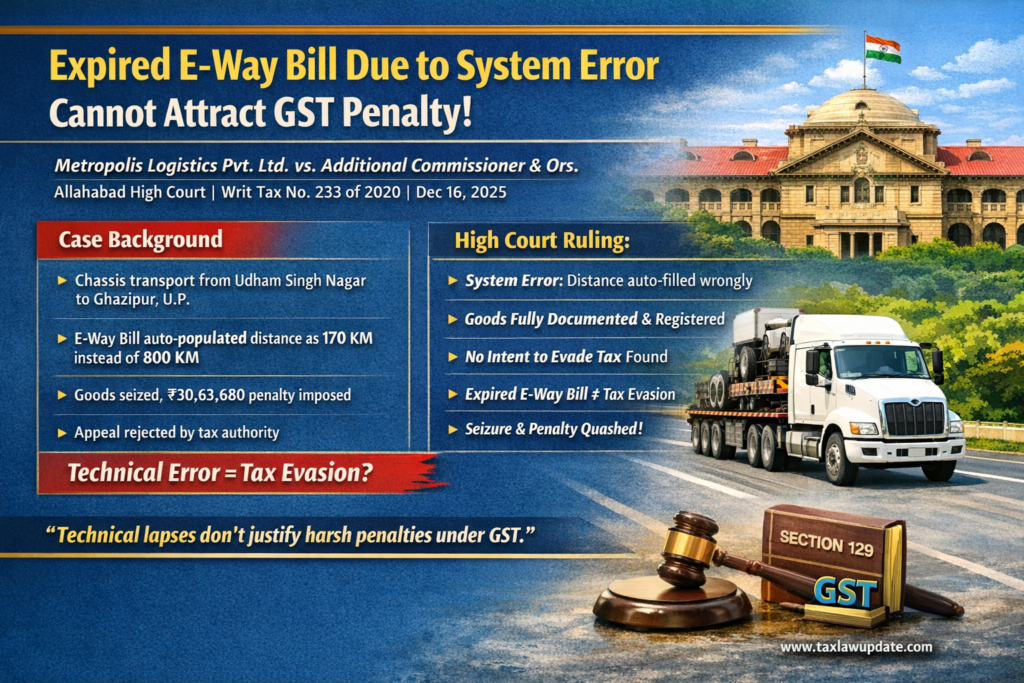

Metropolis Logistics Pvt. Ltd. vs. Additional Commissioner & Ors.

Allahabad High Court | Writ Tax No. 233 of 2020 | Decided on 16.12.2025

🔹 Introduction

The Allahabad High Court, in a significant judgment, has once again clarified that mere expiry of an e-way bill—without any intention to evade tax—cannot justify seizure of goods or imposition of penalty under Section 129 of the GST Act.

In Metropolis Logistics Pvt. Ltd. vs. Additional Commissioner, the Court quashed the penalty and seizure order, holding that technical errors caused by auto-generated data in the GST portal cannot be treated as tax evasion.

This ruling reinforces the principle that GST enforcement must be based on substance, not technicalities.

🔹 Facts of the Case

➤ Parties Involved

- Petitioner: Metropolis Logistics Pvt. Ltd.

- Respondents: Additional Commissioner & Others

- Court: Allahabad High Court

- Judge: Hon’ble Justice Piyush Agrawal

➤ Transaction Details

- The petitioner is a registered logistics company.

- Goods involved: Motor vehicle chassis

- Origin: Ashok Leyland, Udham Singh Nagar (Uttarakhand)

- Destination: Ghazipur, Uttar Pradesh

- Consignee: M/s Pawansut Automobile India Pvt. Ltd.

- Documents carried:

- Tax invoice

- E-way bill

- Trade certificate

- Temporary registration under Rule 43 of CMVR, 1989

🔹 Issue That Led to Seizure

🔹 The e-way bill auto-generated distance of 170 km, whereas the actual distance was around 800 km.

🔹 Due to this incorrect distance, the e-way bill expired earlier than required.

🔹 Goods were intercepted after expiry and seized under Section 129(3) of the GST Act.

🔹 A penalty of ₹30,63,680 was imposed.

🔹 Appeal was rejected by the appellate authority.

🔹 Key Legal Issue

Whether mere expiry of an e-way bill due to system-generated distance error amounts to tax evasion justifying seizure and penalty under Section 129 of the GST Act?

🔹 Arguments by the Petitioner

✔ All statutory documents were available

✔ Goods were genuine and traceable

✔ No mismatch in invoice or consignee

✔ Distance error occurred due to auto-population in Part-B

✔ Part-B details cannot be edited manually

✔ No intent to evade tax

✔ New e-way bill was generated subsequently

✔ Entire transaction traceable on GST portal

🔹 Stand of the Department

❌ E-way bill had expired

❌ It was the duty of the assessee to cancel and regenerate

❌ Expired e-way bill attracts penalty under Section 129

🔹 Court’s Observations & Findings

✅ 1. Goods Were Genuine and Properly Documented

The Court noted that:

- The vehicle had valid registration

- Proper tax invoice and trade certificate were present

- Goods were not suspicious or unaccounted

✅ 2. Error Was System-Generated, Not Intentional

The Court accepted that:

- Distance was auto-filled

- Assessee had no control over auto-population

- Such technical errors cannot be equated with tax evasion

✅ 3. No Intention to Evade Tax

The Court emphasized:

“There cannot be any intention attributed to the petitioner for avoiding payment of tax.”

✅ 4. Expired E-Way Bill ≠ Tax Evasion

The Court reiterated that:

- Expiry alone does not prove mens rea

- Penalty under Section 129 requires intent to evade tax

✅ 5. Consistent View of Courts

The Court relied on multiple judgments, including:

📌 Assistant Commissioner vs. Satyam Shivam Papers (SC)

📌 Ashoka P.U. Foam (Allahabad HC)

📌 Riadi Steels LLP (Allahabad HC)

📌 Sun Flag Iron & Steel Co. Ltd.

📌 Falguni Steels

📌 Globe Panel Industries

All held that:

Minor procedural lapses or expired e-way bills do not justify seizure.

🔹 Final Verdict

✅ Seizure order quashed

✅ Penalty set aside

✅ Writ petition allowed

✅ No violation of Section 129 established

🔹 Legal Principles Established

| Principle | Explanation |

|---|---|

| Technical lapse ≠ tax evasion | Mere expiry is not fraud |

| Intent is essential | Section 129 requires mens rea |

| Auto-generated error | Cannot be attributed to taxpayer |

| Movement traceable | GST portal already records movement |

| Harsh action unjustified | Seizure must be reasonable |

🔹 Practical Takeaways for Taxpayers & Transporters

✅ Always carry valid invoice & registration

✅ Ensure e-way bill is generated correctly

✅ If error occurs due to portal issue, document it

✅ Generate fresh e-way bill where possible

✅ Penalty can be challenged if no tax evasion intent

🔹 Conclusion

The Allahabad High Court has once again upheld the principle that GST law is meant to prevent tax evasion, not to penalize honest taxpayers for technical or system-driven mistakes.

This judgment strengthens taxpayer protection against arbitrary seizure and reinforces judicial discipline in GST enforcement.

📌 Citation:

Metropolis Logistics Pvt. Ltd. vs. Additional Commissioner & Ors.

Writ Tax No. 233 of 2020

Allahabad High Court | Decided on 16.12.2025