Turning 60 is a big milestone — a time when retirement planning matters more than ever and financial safety becomes a top priority.

Life after 60 brings a shift in priorities. Unlike younger investors, senior citizens should focus less on high returns and more on capital safety, steady income, and liquidity.

In 2026, with changing interest rates and rising expenses, choosing the right investment mix has become crucial.

This blog covers the best investment options for senior citizens in India in 2026, explained in a practical and easy-to-understand manner.

As living costs rise, many retirees worry whether their hard‑earned savings will last. A recent retirement study found that only 37% of urban Indians expect their savings to last more than ten years after they stop working — check the study source for details if you’d like to read further.

In 2026, senior citizens in India can choose from a range of investment avenues that focus on safety and steady income. With inflation and medical costs increasing, it’s important to check your risk tolerance (how much ups and downs you can accept) and your liquidity needs (how quickly you might need cash) before choosing any plan.

What you’ll learn

A quick roadmap: this article explains safe investment options for senior citizens, compares key government schemes and bank deposits, shows practical monthly‑income models, and highlights tax points to help you plan your retirement with confidence.

Key Takeaways

- Prioritise simple, safe investment options that protect capital while delivering regular income.

- Consider government-backed schemes for predictable returns and added security.

- Assess your personal risk tolerance and liquidity needs before locking money away.

- Build reliable regular income streams to cover day-to-day expenses in retirement.

- Remember that inflation and rising medical costs can quickly erode savings — factor them into your plan

- Before selecting any investment, senior citizens should evaluate:

- Safety of capital

- Regular income (monthly/quarterly)

- Liquidity in emergencies

- Tax impact on interest income

- Ease of operation and nomination facility

- High returns should never be the first priority after retirement.

Read on for straightforward, practical ideas to help you secure a steady income after 60.

The Financial Reality for Seniors in 2026

In 2026, many Indian seniors face clear financial realities: preserving capital, creating steady income and making sure savings cover everyday costs and healthcare. Good retirement planning balances safety with modest returns so your money lasts as long as you need it.

Prioritising Safety Over High Returns

Seniors should favour safety over chasing high returns that carry big risk. Predictable, low‑volatility choices — such as fixed-income securities and government-backed investment schemes — help protect capital and deliver regular income suited to everyday needs.

The Impact of Inflation on Retirement Savings

Inflation quietly reduces the value of fixed income over time. For example, with a constant inflation rate of 4% a year, the purchasing power of ₹100,000 falls to about ₹67,556 in 10 years (compound effect). In plain terms: plan for inflation when you set withdrawal rates and pick investment products.

Rising Medical Costs and Financial Planning

Healthcare spending often rises with age, so factor medical costs into your retirement plan. Include emergency funds and consider products that leave room for unexpected bills or long‑term care.

| Expense TypeAverage Cost (approx.)Projected Cost in 5 Years (approx.) | ||

| Medical Emergencies | ₹50,000 | ₹60,000 |

| Long-term Care | ₹200,000 | ₹250,000 |

Note: figures in the table are approximate. Check current local rates and health‑care inflation in your area when planning.

If you’re unsure how inflation or rising medical costs affect your retirement needs, consult a certified financial adviser to review your investment mix and liquidity needs.

Key Factors Seniors Must Consider Before Investing

Before you choose any investment, check a few simple but important points so your savings support regular expenses in retirement. A clear investment plan for senior citizens focuses on preserving capital, keeping some money accessible, and ensuring steady periodic payouts where needed.

Assess Your Risk Tolerance

Understand how much risk you can comfortably bear. After 60, many prefer low‑risk, safe investment options that give predictable returns. A quick rule: if you cannot afford to lose capital, favour fixed income or government‑backed schemes over high‑volatility choices.

Check Your Liquidity Needs

Decide how quickly you might need cash. If you expect to use funds within 1–3 years, avoid long lock‑in periods. As a guideline, keep 6–12 months of living costs in liquid instruments (savings, short‑term deposits or a sweep‑in account) so you can pay for emergencies without breaking long‑term investments.

Match Investments to Your Horizon

Think in terms of the time you plan to keep money invested. Short horizon (under 3 years): choose liquid or short‑term fixed income. Medium (3–7 years): consider a mix of conservative debt funds and deposits. Long horizon (7+ years): you can include modest growth options that balance safety and returns. Align each investment option with its intended period.

Review Health Insurance and Contingency Cover

Make sure you have adequate health insurance before locking away large sums. Medical costs rise with age, so keep a buffer or an emergency fund and consider products that allow partial withdrawals or loans against the investment if needed.

Practical tip: if you’re unsure, download a short checklist (risk tolerance, liquidity, horizon, health cover) or speak to a certified financial adviser to build a personalised investment plan.

Senior Citizen Investment Options in 2026: Safe Income After 60

In 2026, seniors in India can choose from several straightforward investment options that focus on safety and reliable income. Below are the main types of instruments to consider, with a simple note on how each pays out and who it suits.

Fixed Income Securities

What they are: Bonds and debentures issued by governments or companies that pay regular interest. Why seniors like them: predictable coupon payments and relatively low volatility compared with equity.

Government-Backed Investment Schemes

What they are: Schemes run or guaranteed by the government, designed for safety and steady returns. Examples include the Senior Citizen Savings Scheme (SCSS), Pradhan Mantri Vaya Vandana Yojana (PMVVY) and the Post Office Monthly Income Scheme (POMIS). Why seniors like them: high emphasis on capital protection and regular payouts.

“Government-backed investment schemes offer a secure way for seniors to earn a regular income, backed by the government’s guarantee.”

Bank Deposit Options

What they are: Fixed deposits (FDs) and recurring deposits (RDs) with banks. Many banks offer special FD rates for senior citizens. Why seniors like them: simplicity, safety and easy access to bank services.

Special FD Rates for Seniors

Banks often pay a higher interest rate on FDs for senior citizens. These FDs are useful if you want low risk and fixed returns for a chosen tenure.

“As of 2026, senior citizens in India can earn up to ~8.80% p.a. on fixed deposits, especially with select small finance banks. Traditional public and private sector banks also offer competitive FD rates (generally ~6.75%–7.30% p.a. for senior citizen tenures). Rates vary by bank, tenure, and amount, and senior citizens usually receive an extra premium over regular depositor rates. FD interest is taxable, but seniors can claim deductions under Section 80TTB for up to ₹50,000.”

Recurring Deposit Plans

Recurring deposit plans let you put away a small amount regularly and earn interest — a disciplined way to save and build a steady pot that can later generate income.

“Recurring Deposits (RD) are a safe and disciplined way for senior citizens (aged 60+) to grow their savings. Seniors usually receive higher RD interest rates (0.50%–0.75% extra) compared with regular depositors. RD earnings are compounded quarterly and offer predictable returns, making them ideal for retirement income planning. Interest is taxable, but seniors enjoy a higher TDS threshold (₹50,000), can submit Form 15H, and claim a deduction up to ₹50,000 under Section 80TTB.”

| Investment OptionTypical Return (example) | (as of [month/year])TenureWho it suits | ||

| SCSS | 8.2% (example) | 5 years | Seniors wanting quarterly income and government safety |

| PMVVY | 7.4% (example) | 10 years | Those seeking guaranteed annuity-type payouts |

| POMIS | 7.4% (example) | 5 years | People needing monthly cash flow and high safety |

| Bank FDs (senior rates) | Varies by bank (example range 5–7%) | 1–10 years | Investors seeking flexibility and safety |

Note: interest rates shown are illustrative examples. Rates change frequently — check official sources (RBI, India Post, bank websites) for current figures.

Practical example: if you need predictable monthly payouts, SCSS or POMIS may be a good fit; if you want flexible withdrawals, consider bank FDs or short‑term fixed‑income securities. Assess each option for safety, liquidity and how well it meets your income needs.

Senior Citizen Savings Scheme (SCSS) in 2026

The Senior Citizen Savings Scheme (SCSS) remains a strong choice in 2026 for senior citizens seeking a safe, regular source of income. It is a government-backed scheme designed to protect capital while paying steady returns, making it useful for those who prioritise safety over high-risk growth.

Updated Interest Rates and Terms

SCSS pays interest quarterly and has a standard tenure of five years, which can be extended by a further three years. Interest rates change periodically, so always check the official rate as of the current month before investing. The quarterly payout makes SCSS particularly suitable for investors who want predictable cash flow.

Eligibility Criteria and Investment Limits

To open an SCSS account, an investor must be a senior citizen (60 years or older). The maximum investment limit is ₹30 lakh. The scheme allows account holders to receive regular interest while keeping the principal relatively secure under government backing.

- Eligibility: Individuals 60+ years; 55+ for retired civilians; 50+ for retired defense personnel.

- Investment Amount: Minimum ₹1,000, maximum ₹30 lakhs (combined across all accounts).

- Tenure: 5 years, extendable by another 3 years.

- Tax Benefits: Deposits qualify for deduction under Section 80C of the Income Tax Act.

- Premature Closure: Allowed after 1 year with a penalty (1.5% of principal if closed before 2 years, 1% after 2 years).

- Accounts: Can be opened at authorized banks or post offices.

SCSS vs Fixed Deposits in 2026: A Comparative Analysis

When comparing SCSS with bank fixed deposits, consider interest, tax treatment and liquidity. SCSS often offers a higher interest rate than many standard fixed deposits and pays interest quarterly, while fixed deposits typically pay monthly, quarterly, or at maturity, depending on the plan.

Interest Rate Differences

SCSS rates are usually set by the government and may be higher than ordinary bank FD rates for the same period. Because rates change, list the “rate as of [month/year]” near any numeric example you use.

Tax Benefits Comparison

Tax treatment matters: interest from SCSS is taxable, but senior citizens may be eligible for deductions on interest income under Section 80TTB (see the Taxation section for details). Fixed deposits are taxed as per the investor’s income slab and may attract TDS if interest crosses the threshold. Deposits qualify for deduction under Section 80C of the Income Tax Act.

| Investment OptionInterest RateTax Benefits | ||

| SCSS | Higher than many FDs (check rate as of [month/year]) | Interest taxable; possible relief under senior-specific provisions (see tax section) |

| Fixed Deposits | Varies by bank; often lower than SCSS | Interest taxable per income slab; TDS may apply |

Who should choose SCSS? Seniors who want government-backed safety, regular quarterly income and a medium-term tenure (5 years with a possible 3-year extension). If you need flexible withdrawals, a bank fixed deposit or short-term deposit may be more suitable.

Checklist before you invest: proof of age, identity and address documents, nominee details, and confirmation of the latest SCSS interest rate from the official government page.

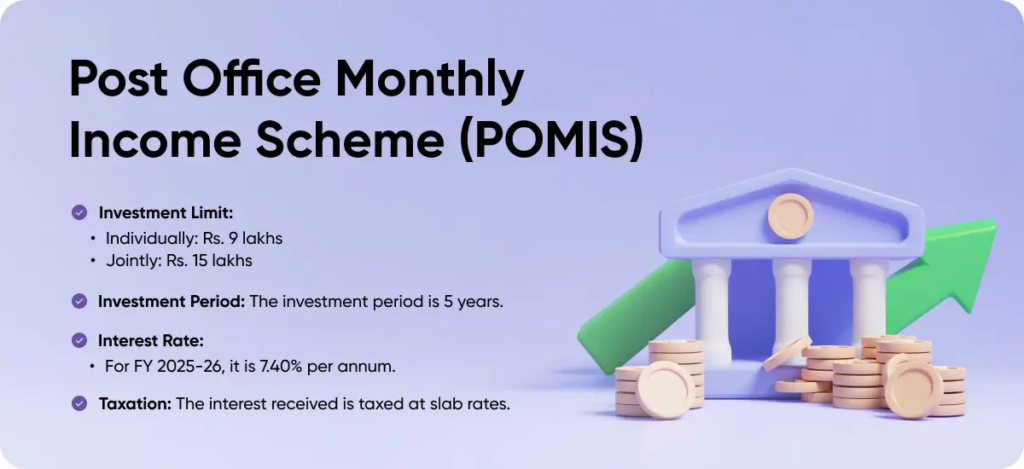

Post Office Monthly Income Scheme for 2026

The Post Office Monthly Income Scheme (POMIS) is a government-backed scheme that suits retirees who want a safe, predictable monthly payout. Because it is backed by the postal department, many senior citizens prefer it for steady income and capital protection.

Current Interest Rates and Returns

POMIS pays a fixed monthly interest. Interest rates change from time to time, so always check the official India Post page for the latest figure (showing “rate as of [month/year]”). The plan’s monthly payout is calculated from the prevailing interest rate on the invested sum, giving a predictable cash flow each month.

Investment Limits and Tenure

POMIS allows a maximum investment of ₹9 lakh for an individual account and ₹15 lakh for a joint account, with a standard maturity period of five years. These limits and the fixed five‑year tenure make the scheme suitable for those who want short‑to‑medium term safety with monthly income.

Withdrawal and Reinvestment Options

POMIS offers straightforward withdrawals: the monthly interest can be credited directly to your bank account. On maturity, you can withdraw the principal or reinvest it into another scheme. Check whether your local post office allows premature closure and what penalties, if any, will apply.

| Investment TypeMaximum InvestmentMaturity Period | ||

| Individual Account | ₹9 lakh | 5 years |

| Joint Account | ₹15 lakh | 5 years |

Who is POMIS best for? Conservative investors and retirees who need a dependable monthly payout and value government-backed safety. For an exact estimate of monthly income, check the current POMIS rate (India Post) and use a simple monthly income calculator.

Key Features and Benefits of POMIS

- Monthly Payouts: Provides a steady, fixed income, making it ideal for retirees.

- Interest Rate: The rate is 7.40% per annum, paid monthly.

- Investment Limits: Minimum ₹1,000, and maximum ₹9 lakh for a single account, ₹15 lakh for a joint account (up to 3 adults).

- Tenure: 5 years.

- Premature Withdrawal: Allowed after 1 year with a penalty (1-3 years: 2% deduction; after 3 years: 1% deduction).

- Taxation: No TDS is deducted, but interest is taxable and does not qualify for section 80C benefits.

- Eligibility: Resident Indians, including minors (10+ years).

How to Open a POMIS Account

- Visit Post Office: Go to the nearest Post Office.

- Documents: Submit the application form, ID proof (Aadhar/PAN), address proof, and photographs.

- Deposit: Open with cash or cheque.

- Nomination: Nomination facility is available.

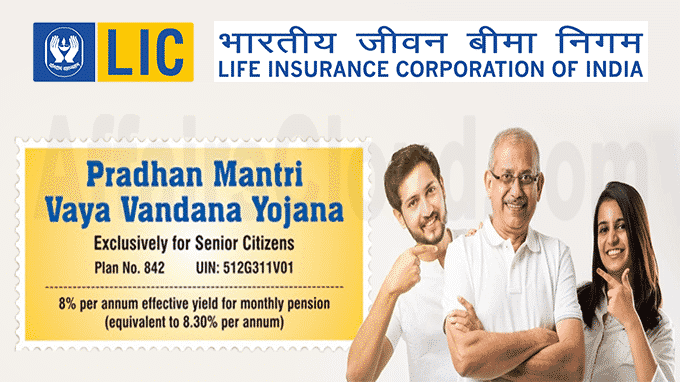

Pradhan Mantri Vaya Vandana Yojana (PMVVY)

What is PMVVY?

Pradhan Mantri Vaya Vandana Yojana (PMVVY) is a government-backed pension scheme for senior citizens, implemented through Life Insurance Corporation of India (LIC).

It provides assured monthly/quarterly/annual pension for a fixed period of 10 years, offering income stability after retirement.

Key Features of PMVVY

- Eligibility: Senior citizens aged 60 years or above

- Policy Term: 10 years

- Guaranteed Pension:

- Monthly / Quarterly / Half-yearly / Yearly option

- Risk Level: Very low (sovereign backing via LIC)

- Capital Protection: Purchase price returned on maturity

- Premature Exit: Allowed in exceptional cases (medical emergencies)

- Loan Facility: Available after 3 years (up to 75% of purchase price)

Investment Limits

- Minimum Pension: ₹1,000 per month

- Maximum Pension: ₹10,000 per month

- Maximum Investment: Around ₹15 lakh (subject to notified limits)

Who Should Consider PMVVY?

PMVVY is ideal for:

- Retired individuals needing fixed monthly income

- Senior citizens not comfortable with market risk

- Those comparing FD vs SCSS vs PMVVY

- Parents dependent on pension-style cash flow

PMVVY vs Other Senior Citizen Options (One-line comparison)

- FD → Interest rate fluctuates

- SCSS → 5-year term, interest taxable

- PMVVY → 10-year assured pension + maturity protection

Taxation (Important Disclaimer Point)

- Pension received is taxable as per slab

- No deduction under Section 80C

- No TDS exemption benefit

National Pension System (NPS) — Retirement Planning for Senior Citizens

“The National Pension System (NPS) is a voluntary, government-regulated retirement planning scheme available to Indian citizens aged 18–70. It allows subscribers to build a retirement corpus through regular contributions invested in diversified assets. After age 60, up to 60% of the accumulated wealth can be withdrawn as a lump sum, and the remaining 40% must be used to purchase an annuity for lifelong pension. NPS also offers compelling tax benefits under Section 80CCD, making it an effective long-term retirement tool for senior citizens.”

What is NPS?

The National Pension System (NPS) is a government-backed, voluntary, defined-contribution retirement savings scheme designed to help individuals build a retirement corpus through systematic contributions while they work, and receive pension income after retirement. It’s regulated by the Pension Fund Regulatory and Development Authority (PFRDA).

Key Features of NPS (Especially for Seniors)

Who Can Join?

- Any Indian citizen (resident or non-resident) aged 18–70 years can open an NPS account.

- A person can continue the account beyond 60 years and contribute up to age 75 (and up to 85 under revised norms), giving more years for retirement savings growth.

Tip :- This means someone close to retirement (like 59–60 years) can start and benefit from NPS, though the total corpus may be smaller than someone investing for longer.

🪙 How It Works

- You contribute regularly to your NPS Tier-I account (main pension account).

- The funds are invested in a mix of equity, corporate bonds, government securities, etc., chosen by you (Active mode) or automatically based on age (Auto mode).

- NPS is market-linked, potentially offering higher returns over long periods compared to traditional fixed products.

What Happens After 60 Years

At Retirement (Age 60)

- You can withdraw up to 60% of your total accumulated corpus as a lump sum (often tax-free).

- The remaining 40% must be used to purchase an annuity plan, which provides regular pension income for life.

- If your total corpus is small (below a threshold), you may be allowed to withdraw the full amount without mandatory annuity purchase.

Continue Contributions

- You can choose to continue contributing to NPS beyond 60 up to age 75 or older (depending on revised regulations).

In Case of Death

- The entire accumulated corpus is paid to your nominee/legal heir, providing family security.

Tax Benefits (Big Advantage)

- Contributions to NPS qualify for tax deductions under:

- Section 80CCD(1) (within ₹1.5 lakh overall limit),

- Section 80CCD(1B) (additional ₹50,000).

- This makes NPS a tax-efficient retirement planning tool — helping reduce your taxable income while building pension corpus.

Pros & Cons for Senior Savers

Pros

- Flexible retirement savings — contribute when you want and how much you want.

- Potential for higher market-linked returns versus fixed income options.

- Portable and low-cost, with choice of fund managers and investment allocation.

- Attractive tax deductions and partial tax-free withdrawals.

Cons / Things to Note

- Requires long-term commitment — best suited for those planning retirement systematically.

- Portion of corpus must be converted to annuity for pension (lower liquidity).

- Market risk applies — returns are not guaranteed like in FDs or senior citizen schemes.

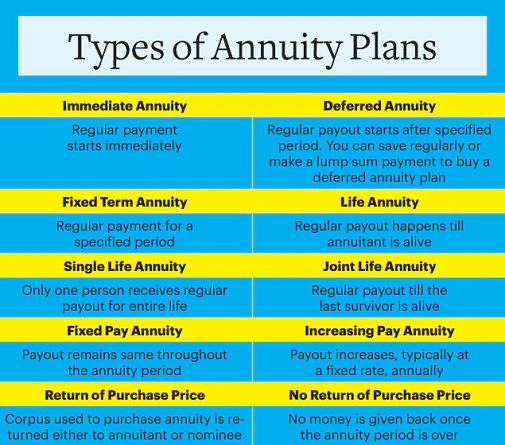

Annuity Options for Senior Citizen

Annuity plans are retirement products that provide guaranteed regular income to senior citizens in exchange for a one-time investment. Available in multiple options such as life annuity, joint life annuity, and annuity with return of purchase price, these plans offer financial stability and predictable pension. While annuity income is taxable and lacks liquidity, it remains a preferred choice for retirees seeking lifelong income without market risk.

Who Should Consider Annuity Plans?

Annuity plans are suitable for:

- Senior citizens aged 60 years and above

- Retirees receiving lump-sum amounts (PF, gratuity, NPS maturity)

- Individuals looking for fixed monthly pension

- Those who prefer zero market risk

Types of Annuity Options for Senior Citizens

Life Annuity (Pension for Life)

- Pension is paid as long as the annuitant is alive

- Payments stop after death

- Highest pension amount among annuity options

Best for: Seniors without dependents, needing maximum monthly income.

Life Annuity with Return of Purchase Price

- Pension paid for life

- On death, the original investment amount is returned to nominee

- Slightly lower pension than pure life annuity

Best for: Seniors who want capital protection for family

Joint Life Annuity (Husband & Wife)

- Pension continues as long as either spouse is alive

- Usually 100% or 50% pension to surviving spouse

- Option of return of purchase price available

Best for: Married couples planning lifetime income for both

Annuity for Guaranteed Period (5, 10, 15, 20 Years)

- Pension paid for a fixed guaranteed period

- If annuitant dies early, pension continues to nominee for remaining years

Best for: Seniors wanting certainty of income for heirs

Increasing Annuity

- Pension increases every year (e.g., 3% or 5%)

- Helps fight inflation

- Initial pension is lower

Best for: Younger seniors concerned about rising living costs

Immediate vs Deferred Annuity

Immediate Annuity

- Pension starts immediately (within 1 month / 1 quarter / 1 year)

- Ideal for already retired individuals

Deferred Annuity

- Pension starts after a chosen deferment period

- Suitable for those retiring in future

Annuity & NPS Connection

Under NPS, at least 40% of the retirement corpus must be used to buy an annuity, making annuity plans a mandatory retirement income tool for many retirees.

Taxation of Annuity Income

- Annuity pension is fully taxable as per income-tax slab

- No Section 80C benefit on purchase price

- Pension income is treated as “Income from Other Sources”

Pros & Cons of Annuity for Senior Citizens

Advantages

- Guaranteed income for life

- No market risk

- Simple & predictable cash flow

- Useful for retirement planning

Limitations

- Pension amount is fixed

- No liquidity after purchase

- Does not beat inflation unless increasing annuity chosen

- Taxable income

Diversifying beyond domestic instruments:-

Diversifying beyond domestic instruments can help Indian senior citizens spread risk and seek betterlong‑term returns. International investment options are increasingly accessible, but they bring extra rules, currency risk and tax considerations — so proceed carefully.

NRI Fixed Deposits

NRI fixed deposits are useful for Indian citizens living abroad or for beneficiaries who hold NRE/NRO accounts. These deposits typically offer fixed returns and low volatility, making them similar in safety to domestic fixed deposits but with cross‑border tax and repatriation rules to check.

International Retirement Funds

International retirement funds invest across global markets and asset classes, giving professional management and broad diversification. They can help reduce country‑specific risk, but check the fund’s fees, historical performance and currency exposure before investing.

Foreign Currency Investments

Investing directly in foreign currencies or currency‑denominated instruments can act as a hedge against Rupee depreciation, but it raises the risk from exchange‑rate swings. Returns may be higher or lower after currency moves are accounted for.

Risk Factors to Consider

Key risks include market volatility, exchange‑rate fluctuations, different regulatory regimes and additional costs (custody fees, withholding taxes). A simple example: if an overseas fund returns 8% but the rupee strengthens 10%, your net return in rupees may be negative.

Regulatory Compliance

Check regulatory and tax rules before investing overseas. Residents investing abroad must follow FEMA limits and report holdings in tax returns. NRIs should check NRE/NRO account rules and local tax treaties — these affect repatriation and tax treatment.

| Investment OptionRisk LevelIndicative Return (range) | ||

| NRI Fixed Deposits | Low | Indicative 4–7% (varies by bank and country) |

| International Retirement Funds | Medium to High | Indicative 6–10% (subject to market cycles) |

| Foreign Currency Investments | High | Variable — depends on currency moves |

Must‑check checklist: tax implications (India and foreign jurisdiction), reporting requirements (FEMA, Income Tax), fees and fund domicile, currency risk and estate/heritage rules. Speak to a cross‑border tax adviser if you plan significant overseas exposure.

Mutual Funds for Senior Citizens: A Balanced Approach

Mutual funds can be a useful part of a senior citizen’s investment mix in 2026, offering a balance between safety and modest returns. They pool money from many investors and are managed by professionals, so you get diversification without having to pick individual securities.

Conservative Debt Funds for Regular Income

What they are: Funds that invest mainly in low‑risk debt instruments such as government bonds, corporate bonds and short‑term papers. Why they suit seniors: lower volatility and steady interest-like returns. You can use a systematic withdrawal plan (SWP) from a conservative debt fund to generate a predictable monthly income.

Monthly Income Plans (MIPs)

What they are: MIPs typically blend debt with a small equity portion to aim for monthly payouts. Why consider them: they can offer slightly higher returns than pure debt funds, but carry more risk due to equity exposure. Treat MIPs as a moderate‑risk option rather than a guaranteed income product.

Dividend Yield Funds for Long-Term Growth

What they are: Equity funds that focus on companies paying steady dividends. Why they suit some seniors: potential for capital appreciation and dividend income over the long term. Bear in mind dividend payments are not guaranteed and equity carries higher short‑term risk.

Risk Assessment for Seniors

Match fund choice to your risk tolerance: conservative debt funds and MIPs are generally lower risk than equity funds, but all mutual funds carry market risk. Before investing, check the fund’s volatility, past performance (3–5 years), and whether its objective suits your income needs.

| Fund TypeRisk LevelSuitable For | ||

| Conservative Debt Funds | Low | Seniors needing regular income with capital stability |

| Monthly Income Plans (MIPs) | Moderate | Those wanting slightly higher yield but accepting some equity risk |

| Dividend Yield Funds | Higher | Investors seeking long‑term growth and dividend potential |

Costs and Practical Tips

Remember fees matter: check the expense ratio, entry/exit loads and any transaction charges. High fees reduce net returns, especially for smaller investments. Use SWPs to receive monthly income and monitor the portfolio annually.

Practical example: if you place ₹10 lakh in a conservative debt fund with an indicative yield of 6% (verify current figures), a 4% annual SWP withdrawal might provide about ₹3,333 per month while preserving capital better than larger withdrawals. (This is illustrative; check actual fund returns and consult an adviser.)

Action steps: read the fund factsheet, compare past 3–5 year returns, check risk metrics (standard deviation, Sharpe ratio) and speak to a certified mutual fund distributor if you need personalised advice.

Creating a Monthly Income Stream: Practical Examples

A steady monthly income helps senior citizens keep financial independence and meet regular expenses. Below are practical ways to generate monthly cash flow, with a sample portfolio and clear assumptions so you can adapt the ideas to your needs.

Systematic Withdrawal Plans from Mutual Funds

Systematic Withdrawal Plans (SWPs) let you withdraw a fixed amount from a mutual fund at regular intervals (monthly, quarterly). SWPs are useful for converting a lump sum into predictable income while keeping the remaining capital invested. Note: withdrawals depend on fund performance, so the capital balance may change over time.

Example: with ₹50 lakh in a conservative debt fund, a modest 4% annual withdrawal could aim to provide a steady monthly cash flow while preserving capital better than larger withdrawals. (See the “Assumptions” box below.)

Annuity Plans from Insurance Companies

Annuity plans convert a lump sum into guaranteed regular payments. Options include term annuities (payments for a set period) and lifetime annuities (payments for life). Annuities suit retirees who want certainty — but compare providers, guaranteed rates and any inflation indexing carefully.

Diversified Income Portfolio Models

Combining instruments — fixed deposits, mutual funds (SWP) and annuities — can balance safety, liquidity and income. Below is a sample allocation; rates used are illustrative, so check current figures before deciding.

Assumptions (illustrative)

- Fixed deposit yield used: 6% p.a.

- Mutual fund SWP sustainable yield: 5% p.a. (after fees; capital may vary)

- Annuity payout (illustrative): 5% p.a. of invested sum (guaranteed portion depends on provider)

Sample Portfolio for ₹50 Lakh Investment

| Investment InstrumentAllocation (%)Allocation AmountAssumed Yield (p.a.)Expected Monthly Income | ||||

| Fixed Deposits | 40% | ₹20,00,000 | 6% | ≈₹10,000 |

| Mutual Funds (SWP) | 30% | ₹15,00,000 | 5% | ≈₹6,250 |

| Annuity Plans | 30% | ₹15,00,000 | 5% | ≈₹6,250 |

| Total | 100% | ₹50,00,000 | ≈₹22,500 |

Note: the original article used a ₹40,000 monthly income example; here we show a conservative illustrative model and transparent assumptions. Your actual monthly income will vary with real rates and annuity terms.

Alternate Portfolios (brief)

Ultra‑conservative: 60% FDs, 30% SCSS/POMIS, 10% liquid funds — highest safety, lower returns. Balanced: 40% FDs/SCSS, 30% SWP in conservative debt funds, 30% annuity — moderate income and safety. Modest growth: 30% FDs, 40% SWP (mix of debt & conservative hybrid funds), 30% annuity — higher potential returns with more market exposure.

Practical SWP example and caution

If you withdraw a fixed amount each month via SWP, monitor the fund’s NAV and your capital. In poor market periods, the capital may fall; in good periods it may grow. Reassess annually and avoid fixed high withdrawal rates that deplete capital too quickly.

Use a monthly income calculator (or ask for a sample spreadsheet) to plug in current returns and see how different allocations affect your monthly payouts and capital over time.

RBI Floating Rate Savings Bonds

RBI Floating Rate Savings Bonds are government-backed instruments offering floating interest linked to the National Savings Certificate (NSC) rate. With a 7-year tenure and sovereign guarantee, these bonds are ideal for senior citizens seeking safety and protection against changing interest rates. However, interest income is taxable and there are limited liquidity options.

These bonds are suitable for senior citizens who can lock money for a longer duration.

What are RBI Floating Rate Savings Bonds?

RBI Floating Rate Savings Bonds (Taxable) are government-backed bonds issued by the Reserve Bank of India on behalf of the Government of India.

They offer safe, floating interest income, making them suitable for risk-averse senior citizens.

Key Features

- Issuer: Government of India (via RBI)

- Interest Rate:

- Floating rate = NSC rate + 0.35%

- Reset every 6 months (Jan & July)

- Interest Payout: Half-yearly

- Tenure: 7 years

- Capital Safety: Sovereign guarantee

- Premature Exit:

- Allowed for senior citizens after lock-in:

- 60–70 yrs → after 6 years

- 70–80 yrs → after 5 years

- 80+ yrs → after 4 years

- No Maximum Investment Limit

- Allowed for senior citizens after lock-in:

Taxation (Must Mention Clearly)

- Interest is fully taxable as per income-tax slab

- No TDS deducted by RBI

- No Section 80C / 80TTB benefit

Who Should Invest?

RBI Floating Rate Bonds are suitable for:

- Senior citizens wanting higher returns than FD

- Investors worried about interest rate fluctuations

- Those looking for 100% safety + periodic income

- Retirees with surplus lump-sum funds

RBI Bonds vs Other Senior Citizen Options (Quick View)

| Feature | RBI Bonds | FD | SCSS | PMVVY |

|---|---|---|---|---|

| Government backing | ✅ | ❌ | ✅ | ✅ |

| Interest type | Floating | Fixed | Fixed | Fixed |

| Interest payout | Half-yearly | Monthly/Quarterly | Quarterly | Monthly |

| Liquidity | Low | Medium | Medium | Low |

| Tax benefit | ❌ | Section 80TTB | Section 80C | ❌ |

Taxation of Senior Citizen Investments in 2026

Taxes affect how much of your investment returns you actually keep. As a senior citizen, knowing the tax rules for interest, dividends and capital gains helps you choose tax‑efficient investments and protect more of your retirement income.

Tax Benefits Exclusively for Seniors

There are specific provisions helpful to seniors. For example, Section 80TTB allows eligible senior citizens to claim a deduction (up to ₹50,000) on interest income from deposits — check the Income Tax Department for the exact limit and eligibility for the current year. Use such concessions to reduce taxable income from bank FDs, post office deposits and similar instruments.

TDS (Tax Deducted at Source) and How to Avoid Unwanted Deductions

TDS is tax deducted by banks and institutions on interest, dividends or other income before you receive it. If your total income is below the taxable threshold, you can avoid TDS on interest by submitting Form 15H to your bank. Form 15H is for senior citizens and must be renewed each financial year; ensure you meet eligibility conditions before submitting.

How to Submit Form 15H (simple steps)

- Obtain Form 15H from your bank or download it from the Income Tax Department website.

- Fill in personal details, estimated total income for the year and declaration that tax is nil.

- Sign and submit the form to each bank or institution where you receive interest.

- Keep a copy and renew the form each financial year if your income remains below the taxable limit.

Tax‑Efficient Investment Strategies

To optimise post‑tax income, consider these approaches:

- Choose tax‑efficient instruments: tax‑free bonds (where available) or instruments with favourable post‑tax returns.

- Use senior-specific deductions (such as Section 80TTB) to lower taxable interest income.

- Stagger deposits across accounts to manage TDS thresholds and avoid lumps that trigger automatic TDS.

- Consider tax implications of annuity payments and mutual fund capital gains—long‑term capital gains and dividends have specific treatments.

| Investment TypeTax BenefitTDS Notes | ||

| Fixed Deposits | No special exemption; deduction under 80TTB may apply | Bank may deduct TDS if interest exceeds threshold; submit Form 15H to avoid if eligible |

| Senior Citizen Savings Scheme (SCSS) | Interest taxable, but check senior provisions and TDS rules | TDS can apply; present Form 15H if eligible |

| Tax‑Free Bonds | Interest may be tax‑exempt (subject to scheme rules) | No TDS on tax‑free interest |

Worked example (simple)

If a senior has ₹60,000 interest income from deposits and qualifies for Section 80TTB with a ₹50,000 deduction, only ₹10,000 becomes taxable interest — reducing tax payable. (This is illustrative; use current tax slabs and consult a tax adviser for precise calculations.)

For cross‑border or complex situations (overseas investments, NRI status, large portfolios), get advice from a tax professional. Check the Income Tax Department website for official guidance and the latest rules on 80TTB, TDS thresholds and Form 15H.

Common Investment Mistakes Seniors Should Avoid

When planning investments in 2026, seniors should avoid a few common pitfalls that can quickly erode hard‑earned savings. A cautious, informed approach keeps more money working for you and reduces unnecessary stress.

Don’t Chase Very High Returns at the Cost of Safety

If an investment promises unusually high returns with little or no risk, be wary. High returns usually mean higher risk. For retirees, prioritise safety of capital and steady income over speculative gains.

Avoid Poor Diversification

Putting all your money into one type of asset or a single scheme increases risk. Spread investments across safe instruments — fixed deposits, government‑backed schemes, conservative debt funds and annuities — to reduce the chance of a large loss.

Don’t Ignore Inflation

Inflation reduces buying power over time. Even safe, fixed returns can lose value if they don’t at least partly keep up with inflation. Factor inflation into long‑term plans and consider including a small portion of growth‑oriented instruments to protect real capital value.

Watch Out for Scams Targeting Seniors

Scammers often target older investors with pressure tactics and “guaranteed” high returns. Red flags include unsolicited calls, requests for upfront payments, unregistered advisers or refusal to show written terms. Always ask for registration details and written paperwork, and check regulator lists (SEBI, IRDAI or your bank).

Before You Invest — Five Quick Questions

- What is the exact product and how does it generate returns?

- What risk could I face and can I afford to lose this money?

- How liquid is the investment — can I withdraw if needed?

- Who regulates the product or adviser — is it registered?

- Do I understand all fees, penalties and tax implications?

Example scam scenario: an agent calls offering “guaranteed 20% returns”, pressures you to invest immediately and asks for payment in cash. Legitimate investments will provide written terms, cooling‑off periods and verified registrations — never rush.

Practical tip: verify any adviser’s registration, ask for references, involve a trusted family member and, if unsure, consult a certified financial planner before committing money.

Best Investment Options for Senior Citizens – PMVVY vs POMIS vs SCSS vs Mutual Funds vs Annuity vs NPS (2026) Comparison:-

Quick Overview (At a Glance)

| Scheme | Income Type | Risk | Tenure | Capital Safety | Ideal For |

|---|---|---|---|---|---|

| PMVVY | Fixed pension | Very Low | 10 yrs | High | Guaranteed monthly income |

| POMIS | Monthly interest | Very Low | 5 yrs | High | Regular post-office income |

| SCSS | Quarterly interest | Very Low | 5 yrs | High | Higher safe returns |

| Mutual Funds | Market returns | Medium–High | Flexible | No | Growth & inflation protection |

| Annuity | Lifelong pension | Very Low | Lifetime | Optional | Pension for life |

| NPS | Market-linked pension | Medium | Till death | Partial | Long-term retirement planning |

Detailed Comparison for Senior Citizens

PMVVY (Pradhan Mantri Vaya Vandana Yojana)

- Implemented by Life Insurance Corporation of India

- Fixed pension for 10 years

- No market risk

- Purchase price returned on maturity

- Pension is taxable

Best for: Seniors wanting guaranteed monthly income with peace of mind

POMIS (Post Office Monthly Income Scheme)

- Backed by India Post

- Monthly interest payout

- 5-year lock-in

- Moderate returns, very safe

- Interest taxable

Best for: Seniors needing simple monthly cash flow

SCSS (Senior Citizen Savings Scheme)

- Government-notified scheme via banks & post offices

- Quarterly interest payout

- 5-year tenure (extendable)

- Higher returns than FD/POMIS

- Interest taxable, Section 80C benefit available

Best for: Seniors seeking higher safe income

Mutual Funds (Debt / Hybrid / Conservative Funds)

- Market-linked returns

- No guaranteed income

- High liquidity

- Better inflation protection

- Capital gains tax applies

Best for: Financially aware seniors who can tolerate some risk

Annuity Plans

- Offered by LIC and private insurers

- One-time investment → lifetime pension

- Options: single life, joint life, return of purchase price

- Pension fully taxable

- No liquidity

Best for: Seniors who want pension for life without risk

NPS (National Pension System)

- Regulated by Pension Fund Regulatory and Development Authority

- Market-linked retirement system

- Up to 60% lump-sum withdrawal at 60

- 40% mandatory annuity

- Excellent tax benefits

Best for: Seniors below 65 planning structured retirement income

Comparison Table :-

| Feature | PMVVY | POMIS | SCSS | Mutual Fund | Annuity | NPS |

|---|---|---|---|---|---|---|

| Guaranteed income | ✅ | ✅ | ✅ | ❌ | ✅ | ❌ |

| Lifetime pension | ❌ | ❌ | ❌ | ❌ | ✅ | ✅ (via annuity) |

| Market risk | ❌ | ❌ | ❌ | ✅ | ❌ | ✅ |

| Capital safety | High | High | High | Market-linked | Optional | Partial |

| Inflation protection | ❌ | ❌ | ❌ | ✅ | ❌ | Partial |

| Liquidity | Low | Low | Low | High | Nil | Limited |

| Tax efficiency | ❌ | ❌ | Partial | Partial | ❌ | ✅ |

Which Option Is Best for Senior Citizens?

There is no single “best” option. A combination approach works better:

- Safety + Income → PMVVY / SCSS / POMIS

- Lifetime pension → Annuity

- Growth & tax saving → Mutual Funds + NPS

Conclusion: Securing Your Financial Future After 60

Senior citizens in India have a range of sensible investment choices in 2026 to help secure their financial future. By focusing on safety, steady income and sensible diversification, you can build a plan that matches your needs and gives peace of mind.

Three simple next steps: review your portfolio yearly, check that you have adequate health cover and an emergency cash buffer, and adjust allocations so your investments match your risk tolerance and income plans.

Remember: good retirement planning balances capital protection with modest growth where appropriate. Avoid common mistakes, keep an eye on inflation and tax rules, and consult a qualified adviser if you need personalised help.

If you’d like, use a monthly income calculator or book a short consultation with a certified adviser to create a tailored plan that keeps your retirement safe and comfortable.

FAQ

Last updated: [month year]. Rules and rates change — check official sources (RBI, Income Tax Department, India Post) for current details.

Q: What are the best investment options for senior citizens in 2026?

A: Safe investment options for senior citizens include fixed‑income securities, government‑backed schemes (like SCSS and POMIS), and bank fixed deposits with special senior rates. Choose based on your need for regular income, safety and liquidity; see the relevant sections above for comparisons.

Q: How does inflation affect retirement savings?

A: Inflation reduces the buying power of fixed returns over time. To protect savings, plan withdrawals conservatively, include some growth‑oriented instruments and review your portfolio yearly to keep pace with rising costs.

Q: What factors should seniors consider before investing?

A: Assess your risk tolerance, liquidity needs, investment horizon and health insurance cover. These determine whether to favour FDs, government schemes, conservative mutual funds or annuities. Use the “Key Factors” checklist earlier in the article.

Q: What are the benefits of the Senior Citizen Savings Scheme (SCSS)?

A: SCSS is government‑backed, offers regular quarterly payouts and strong capital safety for many seniors. Check the current SCSS rate and eligibility (60+ years) on the official government page before investing.

Q: Can senior citizens invest in international investment options?

A: Yes. Options include NRI fixed deposits, international retirement funds and foreign‑currency instruments. These can diversify your portfolio but add currency, regulatory and tax complexity — consult a cross‑border tax adviser and check FEMA/Income Tax rules.

Q: How can seniors create a monthly income stream?

A: Use systematic withdrawal plans (SWPs) from conservative mutual funds, annuity products for guaranteed payouts, or a mix of FDs, SCSS/POMIS and annuities to build a diversified monthly income model — see our sample portfolios and assumptions above.

Q: What are the tax implications of senior citizen investments?

A: Interest and dividends are generally taxable, but seniors have concessions such as deductions under Section 80TTB and the ability to submit Form 15H to avoid TDS when eligible. For details and thresholds, consult the Income Tax Department guidance linked earlier.

Q: What are the common investment mistakes seniors should avoid?

A: Avoid chasing unrealistic returns, poor diversification, ignoring inflation and falling for scams. Always verify adviser registration, ask for written terms and take time to compare options.

Q: Are mutual funds suitable for senior citizens?

A: Yes — conservative debt funds and certain monthly income or hybrid funds can provide regular income with lower volatility. Check fund factsheets, expense ratios and past 3–5 year performance before investing.

Q: How can seniors ensure a sustainable income stream in retirement?

A: Understand your risk tolerance, build a diversified portfolio of safe instruments, review it annually, include an emergency buffer and adjust withdrawals to match returns. Seek professional advice for complex situations.

Disclaimer

This article is for educational purposes only and does not constitute financial advice. Readers are advised to consult their financial advisor before making investment decisions.