Analysis of Sakshi Enterprises & Shriyaa Enterprises Decisions

📌 Relevant Legal Provision

Section 29 of the CGST Act, 2017 – Cancellation of Registration

Section 29 empowers the GST authorities to cancel a registered person’s GST registration under specified circumstances, including:

- Non-filing of GST returns for a continuous period

- Contravention of provisions of the GST Act

- Registration obtained by fraud or misrepresentation

However, cancellation is not intended to be punitive, especially when the taxpayer is willing to comply and clear all dues.

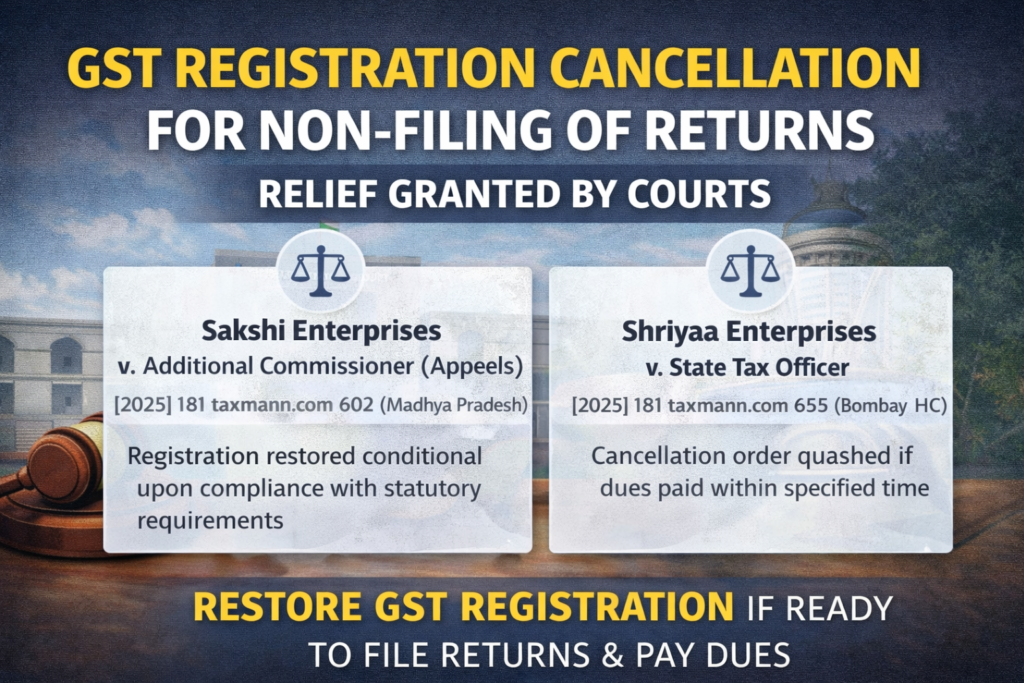

⚖️ Case 1: Sakshi Enterprises v. Additional Commissioner (Appeals)

[2025] 181 taxmann.com 602 (Madhya Pradesh High Court)

🔹 Facts of the Case

- GST registration of the petitioner was cancelled due to non-filing of returns.

- The petitioner explained that non-compliance occurred due to adverse circumstances.

- The petitioner expressed readiness to:

- File all pending returns

- Pay applicable tax, interest, and late fees

🔹 Issue Before the Court

Whether GST registration can be restored when:

- Returns were not filed due to hardship, and

- The assessee is now willing to comply with statutory requirements?

🔹 Observations of the Court

The High Court observed that:

✔ Cancellation of registration severely affects business continuity

✔ GST law is a compliance-based system, not a penal one

✔ If the taxpayer is willing to comply, cancellation should not be permanent

✔ Revenue interest remains protected if dues are paid

🔹 Final Decision

✅ Registration ordered to be restored

✅ Subject to:

- Filing of all pending GST returns

- Payment of tax, interest, and applicable late fees

- Compliance with statutory requirements

📌 Key Takeaway

GST registration should not be cancelled permanently if the taxpayer shows genuine intent to comply.

⚖️ Case 2: Shriyaa Enterprises v. State Tax Officer

[2025] 181 taxmann.com 655 (Bombay High Court)

🔹 Facts of the Case

- GST registration cancelled due to non-filing of returns for six months

- The assessee approached the Court stating:

- Willingness to file all pending returns

- Readiness to pay all dues within 15 days

🔹 Legal Issue

Whether GST registration can be restored when:

- Returns were not filed for a prolonged period

- Assessee undertakes to comply within a fixed time?

🔹 Court’s Observations

The Bombay High Court held:

✔ GST registration is essential for carrying on business

✔ Cancellation should not be mechanical

✔ Purpose of GST law is revenue collection, not business closure

✔ Willingness to comply must be given due weight

🔹 Final Order

✅ Cancellation order quashed and set aside

✅ Restoration allowed subject to:

- Filing pending returns

- Payment of taxes and dues within 15 days

- Compliance with GST provisions

📘 Legal Position Under Section 29 – Explained Simply

| Provision | Legal Position |

|---|---|

| Section 29(2) | Registration can be cancelled for non-filing of returns |

| Section 30 | Registration can be revoked if conditions are fulfilled |

| Court View | Cancellation should not be permanent if compliance is possible |

| Principle Applied | Natural Justice & Business Continuity |

⚖️ Judicial Trend Emerging from These Cases

✔ Courts favor restoration over cancellation

✔ Compliance opportunity must be given

✔ Revenue interest > punitive action

✔ GST law is facilitative, not destructive

🧾 Important Legal Principle Established

“Where the assessee is ready and willing to file pending returns and pay dues, GST registration should be restored rather than permanently cancelled.”

✅ Practical Takeaways for Taxpayers

✔ Delay in filing returns is curable

✔ Registration cancellation is not final

✔ Courts allow restoration if:

- Taxpayer shows bona fide intention

- Dues are cleared

- Compliance is assured

✔ Filing writ petition is effective remedy in genuine cases

📌 Conclusion

The decisions in Sakshi Enterprises and Shriyaa Enterprises reaffirm that:

✔ GST registration should not be cancelled mechanically

✔ Taxpayers must be given a fair opportunity

✔ Compliance-based approach must prevail

✔ Courts consistently protect genuine businesses

These rulings provide strong legal support to taxpayers facing cancellation due to non-filing of returns.